Taxation Reforms a Key Feature of the Budget : Tuhin Kanta Pandey, Finance Secretary

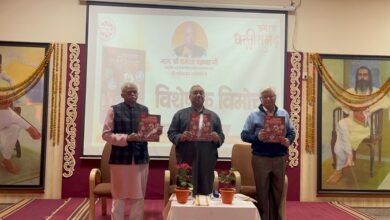

New Delhi : Taxation reforms is a key feature of this budget, as it has an impact on what the rest of the economy does and for the first time is included in Part-A of the budget. Budget making is actually balancing different imperatives and never an exercise in segments. We had a 20-25 percent growth in personal income tax over the last three years. We don’t really gain loading taxes very much on the same taxpayers. We need to create a wider avenue for income generation and an environment of voluntary compliance. A high level of taxation is counterproductive, and we have taken the bold step of not increasing taxes. Our direction is clear, expand the tax base, expand the economy and the taxes will also flow.” Said Mr. Tuhin Kanta Pandey, Finance Secretary and Secretary, Department of Revenue, Ministry of Finance at ASSOCHAM Post Budget Conference.

“The Bharat Trade Net announced in the budget will connect all stakeholders and streamline the customs process and has the potential to be much more than UPI. It’s no longer a question of following standards; our concept of GST has no parallel in the world and we must take pride in what we all have achieved” he added.

Addressing the conference, Mr. Ravi Agrawal, Chairman, Central Board of Direct Taxes, (CBDT), Ministry of Finance said, “The approach of the Tax Department has changed over a period of time. The guiding philosophy is that it is not just about collecting taxes and that tax is basically a derivative of a part of the income, you generate income and then automatically taxes come. The amendments in the Direct Tax Act, change in the tax slabs and rebates has been approached with that perspective. Rationalising TDS, TCS provisions and decriminalizing those provisions, and the concept of updated returns contained in the budget are aimed at facilitating ease of doing business. We are adopting the prudent approach of being proactive, rule-based, user-friendly, database, data-driven, non-intrusive, enabling environment and technology-driven, transparent tax administration.”